Where are the AI revenues? A look at mega cap tech sales multiples

Since the release of ChatGPT, mega cap technology companies poised to profit from AI-enhanced software tools or cloud AI-model training capabilities have seen a surge in their stock prices. Yet, many are yet to realise significant AI-driven revenue growth, let alone a substantial impact on their bottom lines, says Blake Heimann, senior associate, quantitative research, WisdomTree.

This has formed the basis for what Sequoia Capital calls AI's $600bn question – whether today’s capital expenditure (capex) levels can offer an estimated $600B in revenue generated from AI software and services to provide positive return on investment (ROI), given the industry’s heavy investment in hardware infrastructure.

Figure 1: Mega cap tech capex estimates for year end 2024

Source: Koyfin, 29 July 2024. Historical performance is not an indication of future performance and any investments may go down in Value.

The obvious beneficiaries of this investment so far have been Nvidia and its semiconductor peers, experiencing exponential revenue growth due to high demand for AI training chips. With significant capital expenditures being made to purchase these chips and build the next wave of AI data centres, several critical questions arise: Will end users and enterprises see enough value to justify these costs? Will current investments in AI infrastructure deliver positive returns? And, most importantly, are these firms fairly valued?

In this blog, we will focus on valuation, examining whether the current stock prices of these tech giants are justified given the modest impact of AI on their revenues so far.

Valuation trends and market sentiment

The narrative has always positioned AI as a software revolution. While semiconductors serve as essential tools, software will be the key differentiator as users seek the most advanced, intelligent platforms. Consequently, mega cap tech companies have seen significant stock price appreciation since ChatGPT's launch, driven by investor optimism about AI's potential future earnings being concentrated amongst these prominent players. However, this enthusiasm has led to valuation multiple expansions, which many believe may indicate a bubble.

Examining the period since ChatGPT's launch, Figure 2 shows that the Nasdaq forward price-to-sales (P/S) ratio expanded from 3.8 to 5.0, a moderate 34% increase. However, Amazon, Google, Meta, and Nvidia all saw over 50% expansions, with some exceeding 100%. This could imply that these stocks are overvalued or that the market considers them fairly valued, given the expectations of substantial future AI revenues and earnings potential beyond current forward sales estimates.

Figure 2: Forward price/sales multiple expansion after launch of ChatGPT

Source: Bloomberg, 24 July 2024. Period starts when ChatGPT was launched on 30 November 2022. Historical performance is not an indication of future performance and any investments may go down in Value.

More recently, Wall Street's sentiment towards these firms has shifted from positive to negative as investors question the potential ROI from large capital expenditures and the timeline for realising these returns. Last week's earnings reports from major tech companies revealed mixed results.

Amazon's stock declined due to a cautious revenue outlook and disappointing sales, compounded by rising costs to expand Amazon Web Services. Microsoft reported slowing growth in its Azure cloud-computing arm and plans to continue substantial investments in data centers. In contrast, Meta posted strong earnings, appeasing investors and buying time for its AI investments to bear fruit. Meanwhile, Alphabet's shares fell after the company surprised Wall Street with sharply higher costs, overshadowing its better-than-expected sales. The impact of a weaker-than-expected jobs report at the end of the week further exacerbated declines in these stocks, prompting investors to reassess their positions amid a slowing economy. As a result, there have been significant multiple contractions as investors sell shares and reposition themselves. The valuation premium previously afforded to these stocks has diminished, as concerns grow that the AI hype may not meet expectations.

Examining current P/S ratios in the context of historical trends can provide valuable insights into whether valuations have become stretched compared to the past. Figure 3 sheds light on whether the recent pullbacks in stock prices are justified.

Figure 3: Current P/S vs. 10y history

Source: Bloomberg, 24 July 2024. Meta’s P/S Multiple Above/Below the median 10Y historical P/S is not shown due to axis limits, at a value of -12%. Historical performance is not an indication of future performance and any investments may go down in Value.

Nvidia and Microsoft stand out as notable outliers, with current P/S ratios significantly higher than their historical 10-year medians. This could suggest that the market expects fair value for extremely strong growth ahead, or it could indicate overvaluation. By piecing together forward and historical ratios, we see that Amazon, Google, and Meta have recovered from relatively low valuation ratios recently. With significant multiple expansions post-ChatGPT launch, they have returned to valuations in line with their historical numbers. However, the story may be different for Microsoft and Nvidia, as both have experienced significant multiple expansions beyond what is seen in the broader Nasdaq index, materially exceeding historical norms.

AI's potential as a game-changer for mega cap tech companies might justify higher valuations now and into the future. Historically, investing in these firms five or more years ago would have been highly profitable, regardless of valuation. However, current valuations of some indicate a significant 'valuation premium' compared to the past, which likely explains why investors are now more cautious. This caution has contributed to recent price pullbacks, even amidst positive earnings reports.

Historical perspectives on valuations

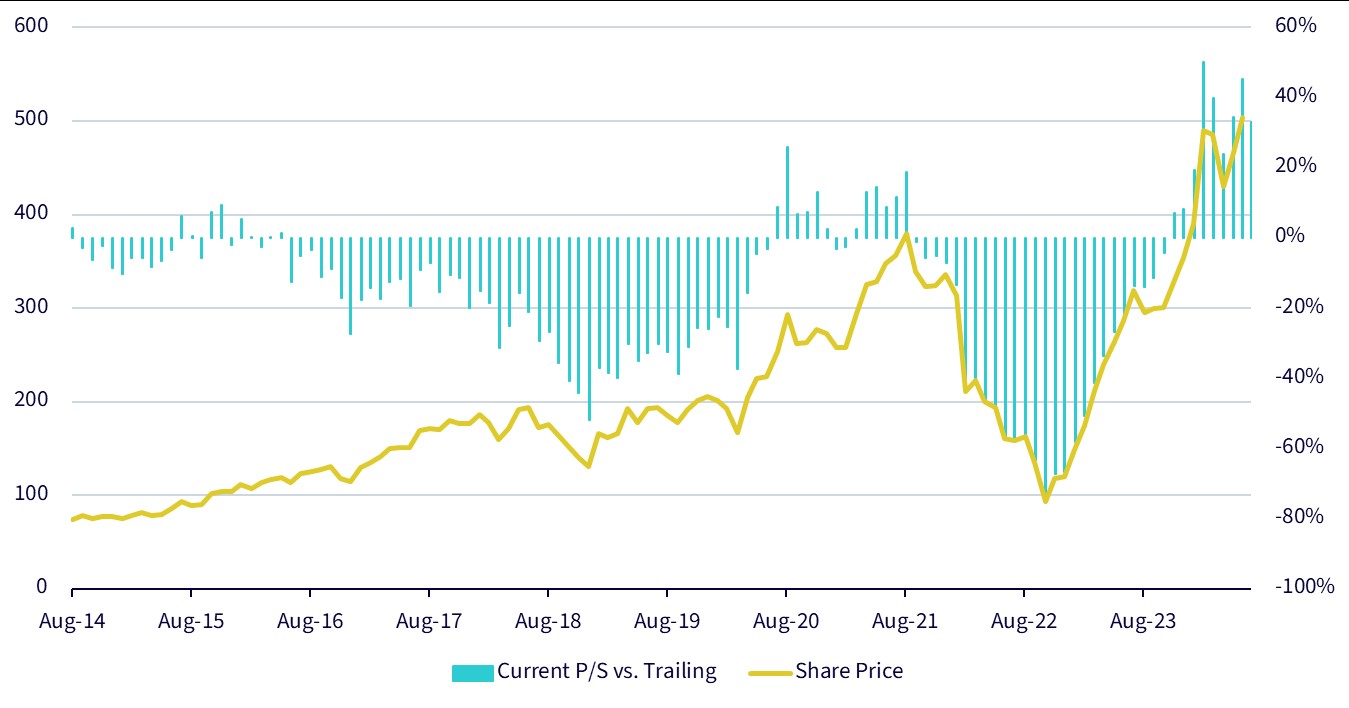

Investing in exponential technologies like AI can benefit portfolios, but it is essential to manage concentration risk and market timing. By being aware of valuation trends, investors can strategically trim positions when overvalued and add when undervalued – following the classic ‘buy low, sell high’ adage. A 10-year chart of Meta illustrates how trimming positions during overvaluation periods and accumulating during undervaluation relative to historical norms could have been beneficial.

Figure 4: Meta price and P/S history (current vs. trailing median)

Source: Bloomberg, 24 July 2024. Historical performance is not an indication of future performance and any investments may go down in Value.

Reflecting on past market bubbles, such as Cisco during the dot-com era, can provide valuable context for remaining valuation-sensitive when investing in technology equities. Cisco's P/S ratio soared to 60 before the stock price collapsed by over 80% in the early 2000s. Comparatively, Nvidia’s current P/S of approximately 35 is not at dot-com bubble levels, indicating a less extreme valuation.

Figure 5: Nvidia vs. Cisco P/S

Source: WisdomTree, Bloomberg as of July 24, 2024. Historical performance is not an indication of future performance and any investments may go down in Value.

This historical perspective helps address the question, ‘How far is too far?’ when valuations seem stretched. While mega cap tech firm P/S ratios have expanded significantly since the onset of the AI wave, it remains well below the extremes seen during the dot-com bubble. This suggests that although valuation multiples have increased since ChatGPT's launch, we are not witnessing a bubble akin to the early 2000’s.

Conclusion

While investing in AI and exponential technologies is exciting, a valuation-aware approach is crucial. Rather than avoiding these investments entirely, investors should adjust their exposure as valuations fluctuate, ensuring they avoid over-concentration at peak valuations and maintain a diversified portfolio.

By Blake Heimann, senior associate, quantitative research, WisdomTree