The three companies inheriting the vast majority of funds from Odey Asset Management and its subsidiary Brook Asset Management are set to receive much smaller strategies in the wake of the Crispin Odey scandal, according to analysis by Investment Week.

A total of ten funds are set to be transferred to Lancaster Investment Management, SW Mitchell Capital and Green Ash Partners.

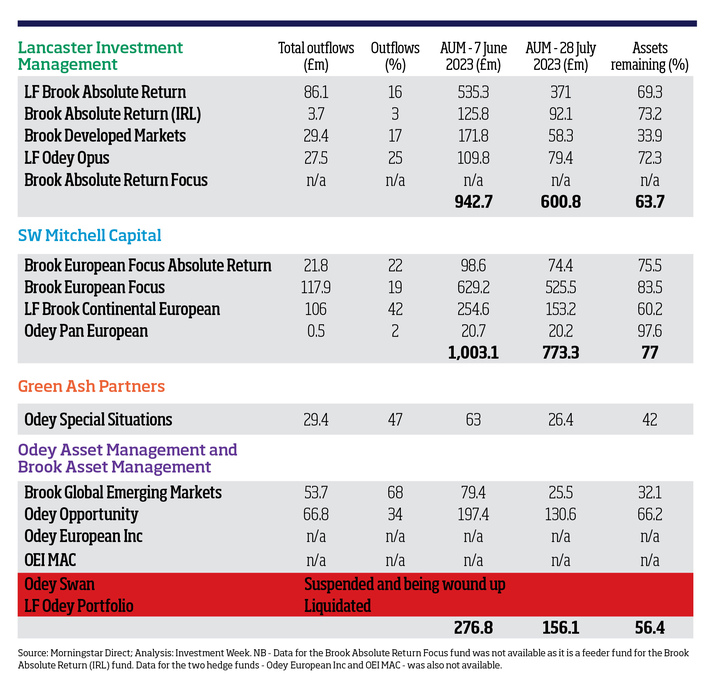

Investment Week analysed data from 7 June 2023, when the FT published its investigation into Crispin Odey's decades of alleged sexual misconduct, until 28 July 2023, when fund manager James Hanbury confirmed he and his investment team would be moving to Lancaster Investment Management and would continue managing the accompanying funds.

Lancaster IM will inherit the most strategies, taking over the five global equity funds managed by Hanbury and his team.

Fund flows and AUM change across publicly listed Odey AM and Brook AM funds between 7 June and 28 July 2023

The funds set to be moved to Lancaster IM - namely LF Brook Absolute Return, Brook Absolute Return (IRL), Brook Absolute Return Focus, Brook Developed Markets and LF Odey Opus - have been significantly reduced, with the aggregated total down 36% between 7 June and 28 July, according to data from Morningstar Direct.

However, Investment Week understands that Lancaster IM will inherit more than just these five strategies, as James Hanbury will also bring over his range of non-publicly listed funds - for which there is no public reporting.

As a result, the overall reduction in assets for both the publicly listed and non-publicly listed funds transferring to Lancaster IM is believed to be around 17%, as of 31 July 2023.

Among the five publicly listed global equity strategies, LF Odey Opus posted the biggest drop over the period, with assets shrinking by more than a quarter (28%) to £79.4m.

Investment Week was not able to obtain data for the Brook Absolute Return Focus fund, as the strategy is a feeder fund for Brook Absolute Return (IRL). No information was available for Odey AM's two hedge funds - Odey European Inc and OEI MAC - but the two funds are undergoing a potential restructure.

SW Mitchell Capital will receive four European equity funds, while Green Ash Partners will take over the Odey Special Situations fund.

The European equity funds headed to SW Mitchell Capital - namely Brook European Focus Absolute Return, Brook European Focus, LF Continental European and Odey Pan European - posted the smallest relative AUM reduction among the strategies that are set to be transferred, with their total size shrinking by 23% over the period.

Green Ash Partners' sole purchase Odey Special Situations has suffered one of the most significant drops in assets, with the fund size as of 28 July totalling just 42% of its 7 June AUM (£63m).

Outflows

LF Brook Continental European witnessed some of the largest outflows of any fund across the businesses, as investors pulled 47% from the strategy between 7 June and 28 July.

Of all the Odey AM and Brook AM funds, the Brook Global Emerging Markets strategy, the future of which is yet to be confirmed, endured the greatest outflows, losing 68% of assets to investor redemptions.

The other publicly listed fund with no future path yet revealed, Odey Opportunity, saw £67m pulled, representing a 34% reduction over the 52-day period.

Overall, the two companies have lost £576m to outflows between 7 June and 28 July, and seen a total reduction in assets of £832m (35%) when other factors, including market movements, are taken into account.

Odey brand ‘too tainted'

Juliet Schooling Latter, research director at Chelsea Financial Services, said the fact the vast majority of the Odey AM and Brook AM funds were being transferred was "welcome", as the "Odey brand is too tainted by the actions of Crispin Odey to continue to retain investors' confidence, and confidence is key in investment management".

When asked about whether the reduced fund sizes may be a problem for the companies inheriting the strategies, she said receiving smaller funds "can sometimes be a good thing". This is because they can be "more nimble and move lower down the cap scale", Schooling Latter explained.

She added: "Managing small funds is not a problem as long as it is economic to do so. It is managing funds in redemption that can be quite challenging for managers, but it seems likely that outflows should slow/cease now that the funds are being transferred.

"It is possible that if the funds are quite small, they could be merged with other funds to give economies of scale, but it is obviously too early to know what will happen in this respect."

Ben Yearsley, investment consultant at Fairview Investing, echoed Schooling Latter's stance on smaller funds, arguing that as long as there is a "well-resourced and supportive fund management business", smaller strategies are not a problem.

He noted, however, one of the bigger issues the companies inheriting the funds will have is convincing potential investors that the alpha delivered so far has been down to the individual manager themselves rather than the company or the influence of Crispin Odey.

Yearsley also highlighted the three companies are not big "names" in the industry, but that should not matter as long as they are "set up correctly with the requisite resource oversight".

"After blow ups in various boutiques over the last few years, investors are becoming much warier on investing with small firms," he added. "I think these funds will struggle raising assets."

The investment consultant also shared a sentiment many within the industry have raised, questioning how much Crispin Odey had or still has invested in some of the funds.

"I cannot imagine he will be sticking with them after being ousted," he said.

Since the Crispin Odey scandal, two funds have reached the end of the road, with Odey Swan currently suspended and being wound up, while authorised corporate director Link Fund Solutions completed the wind-up of the LF Odey Portfolio on 27 July.

The only two strategies that have not been part of any action so far are the Brook Global Emerging Markets and Odey Opportunity funds.

Odey AM, Brook AM, LFS and Green Ash Partners declined to comment. Lancaster IM and SW Mitchell Capital have been contacted for comment.

This article was first published on Investment Week.