The level of UK GDP lost in tax revenue to offshore wealth is one of the highest in Europe, with just Luxembourg, Cyprus, Ireland and Malta ranking higher, according to new research by AML experts, Credas Technologies.

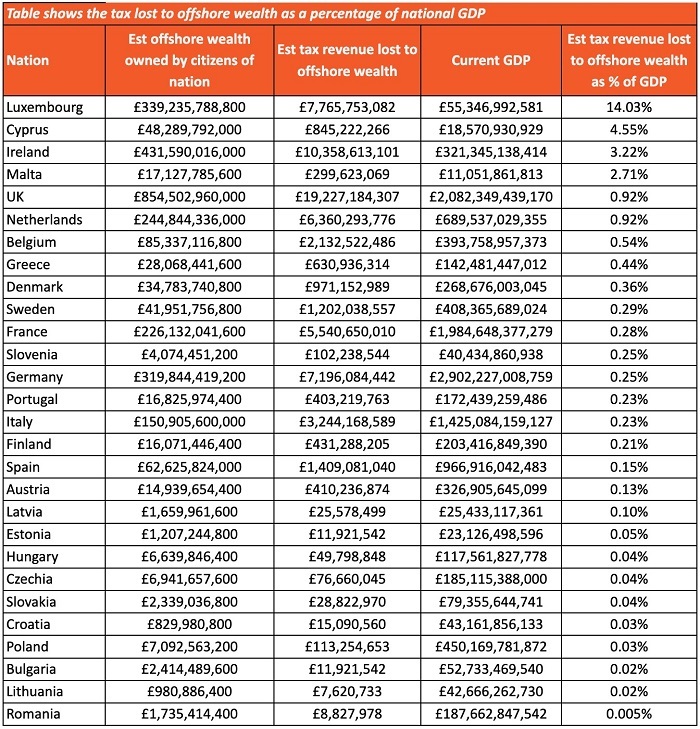

Credas Technologies analysed data on offshore wealth, the lost tax revenue as a result of these strategically placed assets and what this equates to as a percentage of GDP for the UK and other EU nations.

It's estimated that offshore wealth owned by UK citizens totals a huge £845.5bn, by far the highest total compared to any EU nation, with Ireland ranking second at £431.6bn.

This also means that the UK ranks top when it comes to the estimated tax revenue lost as a result of offshore wealth, totalling £19.2bn.

The research by Credas Technologies shows that this £19.2bn is equivalent to 0.92% of the entire GDP of the UK, however, there are some nations that are hit harder from the tax lost to offshore wealth.

Nowhere more so than Luxembourg, where it's thought that total offshore wealth is valued at £339.2bn with the nation losing £7.8bn in tax revenue as a result. This lost tax revenue is equivalent to a huge 14.03% of Luxembourg's GDP.

Cyprus ranks second where the £845.2m in lost tax revenue equates to 4.55% of national GDP, with Ireland (3.22%) and Malta (2.71%) also ranking above the UK.

At the other end of the table, the £8.8m in lost tax revenue from the offshore wealth of Romanian citizens equates to just 0.005% of the nation's GDP, with Lithuania (0.02%) and Bulgaria (0.02%) also ranking amongst the lowest.

Tim Barnett, CEO of Credas Technologies said: "The Ukraine conflict has drawn focus to the illicit activities of some super wealthy individuals and entities within the UK, but it's fair to say that this is certainly a two way street and the tax lost to offshore wealth of UK citizens alone is quite staggering.

"That's not to say that all offshore wealth is illegal but the financial secrecy it provides is often the defining feature that enables, and encourages, non-residents to hide their assets and even their identity while laundering money and abusing their tax responsibilities."

Sign up to our Newsletter

Unlimited access to real-time news, industry insights and market intelligence

Latest Stories

Sign up to our newsletter

Unlimited access to real-time news, industry insights and market intelligence.

© Investment International | Site By Furness Media