UK advisers are prioritising diversification in client portfolios, boosting allocations to alternatives and emerging markets, the latest Schroders UK Financial Adviser Survey has found.

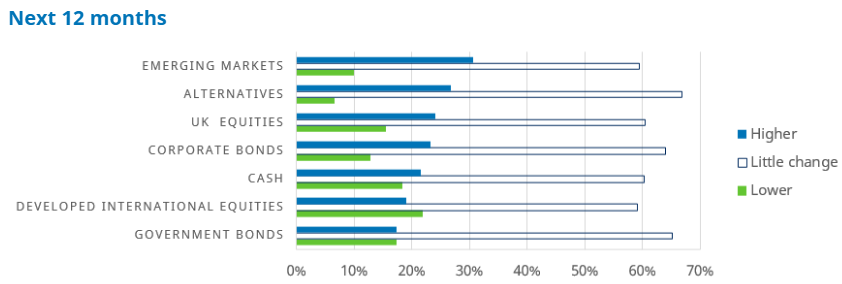

Over the past 12 months, 36% of advisers (from a survey of 221) reported that they had increased their exposure to alternatives and 32% to emerging markets – and the survey results indicated that this is likely to continue into next year.

Adviser sentiment towards Long-Term Asset Funds (LTAFs) is also evolving, with 11% now expecting some of their clients to invest in these vehicles. The proportion of advisers who think clients will not invest has also fallen from 41% to 32% over the past year.

Jamie Fowler, head of UK wealth at Schroders, said: “As we approach the end of another year and look ahead to 2026, the results of this year’s survey underscore the impact that global disruption and ongoing volatility are having on asset allocation decisions.

“Growing caution towards developed markets means advisers and clients will increasingly need to access a broader range of investments.”