The asset management industry is set to face increased commercial pressures in the next two years, with two in three (65%) of asset management executives expecting a significant increase to margin pressure in this period.

The findings come from Carne Group’s latest report – 'Supermodel: the great evolution in asset management' – which surveyed 200 asset management executives on commercial pressures their businesses are set to face in the coming two years.

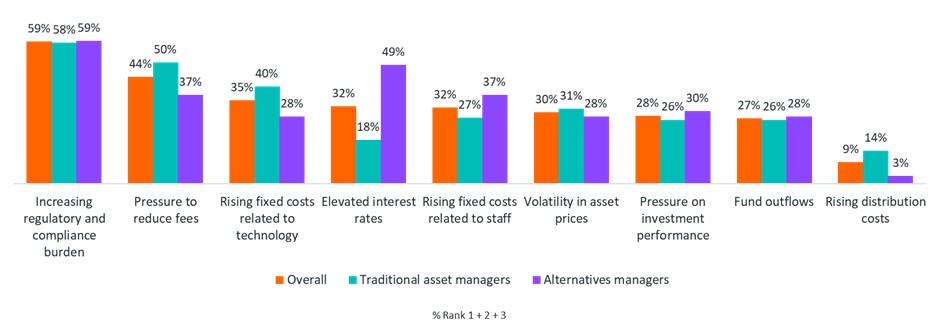

The research found that fee pressure, regulation and operating costs are coalescing to further challenge asset managers’ profitability.

With the continued rise of passive and anticipated market volatility, traditional managers are set to be hit harder, with 72% of executives expecting increased pressure compared to 56% of their counterparts at alternative firms. However, alternative managers are not without their own challenges in the coming period.

The market backdrop is also contributing to margin pressure: 30% of asset managers expect volatility in asset prices to weigh on margins in the coming two years; and 28% think investment performance challenges will be a key factor.

A drive to integrate technology and the latest innovations is also set to eat into margins, with 35% of asset managers citing fixed costs relating to technology affecting their bottom line over this period. Notably, there is a divergence between traditional asset managers and alternative managers, 40% versus 28% respectively, indicating that the uptick in tech investment is going to be more burdensome for traditional managers.

Factors contributing most to increased profit margin pressure over next two years

Downward pressure on fees, driven by the rise of passive investment and increased scrutiny by both clients and regulators on value, is prompting significant challenges for traditional managers. Half (50%) of traditional asset managers have cited the pressure to reduce fees as a key contributor to decreased profit margins in the near future.

Actively managed funds are facing greater pressure to reduce costs. Almost half (47%) of traditional managers expect to face increased pressure on profit margins across their suite of actively managed public funds, though passive funds are not immune from this downward pressure, with 35% expecting increased pressure on passively managed public funds.

At an asset class level, managers think margin pressure will increase to a high extent for equity funds (51%) and bond funds (52%) over the next two years, as competition from passive products in these markets shows no signs of abating. Multi-asset funds (39%) are expected to suffer slightly less.

By comparison, just 29% expect a significant increase in margin pressure for private markets funds and hedge funds.

As a result, the majority (79%) of traditional asset managers expect to undertake some level of product rationalisation, with actively managed funds in public markets (38%) the main target for this.

Elevated interest rates and the war for talent create challenges for alternative managers

While the commercial pressures facing traditional managers are more acute, alternative managers are not without their own challenges.

Despite central banks having begun a rate cutting programme, elevated interest rates are still expected to pose a profitability challenge for 49% of alternative managers, as those managers with investment strategies reliant on leverage grapple with higher borrowing costs. Furthermore, the elevated interest rates are impacting private equity managers’ ability to sell investments when expected by investors.

The fierce competition for talent that has been ignited in the alternatives space is also proving a challenge for these managers, with higher wage bills cited by 37% of alternative managers as a near-term challenge, compared to just 27% of traditional managers.

Against this backdrop, asset management firms are looking at their operational models to alleviate pressure on margins.

While increased technology spend is cited as a near term pressure, it’s expected to yield long-term solutions with digital technologies and automation perceived as the operating model initiatives that could be most effective in reducing margin pressure.

Almost half (47%) of managers also see outsourcing of non-core activities as a means to help improve their profit margin.

With regulatory complexity cited as the greatest contributor to margin pressure, 51% of asset managers with their own management company expect to outsource some of their services to a third-party management company in the next two years to tackle this challenge head on, while 19% expect to fully outsource these services to a third-party management company.

John Donohoe, CEO of Carne Group, said: “The commercial pressures facing the asset management industry are set to heighten yet again in the coming two years. P&L for asset and wealth managers continues to come under more scrutiny. At the same time, we are seeing more CFOs take on the CEO roles as a result

"This is driving a super silent evolution in outsourcing within the industry as firms look to drive efficiencies while trying to focus more of their spend on their growth agenda at the same time. As an example, nearly $2tn of the European funds market is outsourced to management companies – this is 50% more than five years ago. That is an exponential growth rate – and this is going to accelerate in the coming two years.”