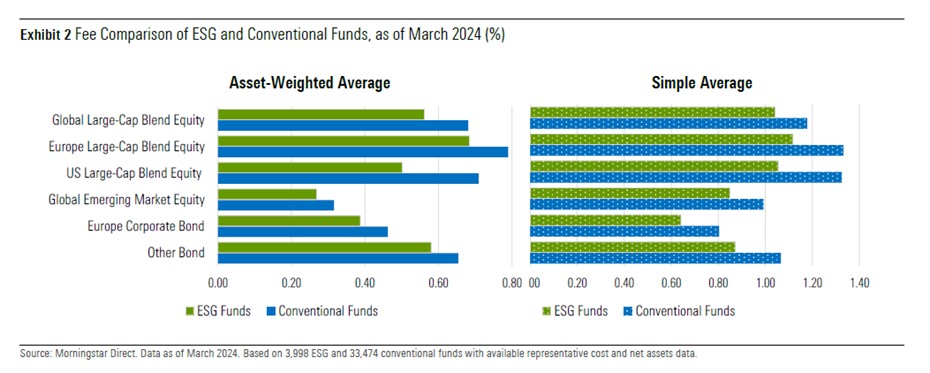

Data published by Morningstar Sustainalytics suggest that ESG funds in Europe are on average not more expensive than non-ESG funds, following increased product availability and growth in competition in the ESG space.

According to a new report - Myth busting: ESG funds aren't more expensive than non-ESG funds - it is commonly thought that additional costs, such as those related to ESG data, research and expertise, would be passed to the end investor.

However, comparing costs of ESG funds in Europe against conventional peers across six of the most popular Morningstar categories over the past decade has found that this is not necessarily the case.

The findings are based on a sample of over 110,000 retail share classes from over 37,400 funds domiciled in Europe, including about 4,000 ESG funds. The six Morningstar categories referenced represent more than 70% of the European ESG fund universe.

Hortense Bioy, head of Sustainable Investing Research, Morningstar Sustainalytics, said: "Investors have been led to believe that ESG-focused funds are more expensive than conventional funds. While there is undoubtedly a wide range of ESG strategies with various price tags out there, we found that, on average, ESG funds don't charge more than non-ESG funds. This is mainly due to the proliferation of new products and growing competition in the ESG space in recent years."

Key findings of the report include:

• ESG funds are not more expensive than their conventional peers, on average. Their costs have declined in recent years partly because of the proliferation of new strategies and intensifying competition in the ESG space.

• The asset-weighted representative costs for ESG funds in six of the most popular Morningstar categories average 0.83%, compared with 0.90% for conventional funds. These were 1.55% and 1.32%, respectively, one decade ago.

• Active ESG funds exhibit lower costs than their conventional peers in five of the six selected categories, as measured by asset-weighted and simple averages.

• Passive ESG funds tend to be on a par with their non-ESG equivalents in four of the six categories, on an asset-weighted average basis. Emerging markets is the only category where passive ESG funds exhibit notably higher expenses, but the gap remains modest, at 0.05%, on average.

• New active ESG funds launched in recent years charge lower fees than new non-ESG funds. This, however, is not always the case for new passive ESG funds.

• Most rebranded ESG funds have maintained or reduced their costs after rebranding. In 2021, when rebranding activity reached record levels, rebranded ESG funds that reduced or kept their costs unchanged accounted for almost 60% of rebranded funds that year.

A copy of the full report can be found here: https://www-preview.morningstar.com/lp/esg-fund-fees